In this edition of HRLaw we provide guidance to employers who are now planning to restructure their workforce in response to changed economic conditions as the end of lockdown comes in to view.

This article covers:

- Flexible furlough and tapering off

- Redundancies

- What payments are employees entitled to receive?

- Changing terms and conditions of employment

- Checklist for employers contemplating contractual changes

1. Flexible furlough and tapering off

As at June 21, 2020 over 9.2 million jobs were furloughed under the Coronavirus Job Retention Scheme (“the Scheme or CJRS Scheme”), but it is a costly scheme which will be phased out during the remainder of the year. Here are the answers to the key questions about how the Scheme will operate from now on:

Can I still furlough?

Changes to the Scheme came force on 1 July 2020 and now only employees who have been furloughed for a minimum period of three weeks up to 30 June are able to benefit from the Scheme. This means that the cut-off date for including new employees in the Scheme was 10 June 2020 with exceptions for employees who had been on maternity, shared parental, paternity or parental bereavement leave provided the employer had furloughed at least one other employee prior to that date. Employees who were already on furlough prior to this date can benefit from the new more flexible arrangements set out below.

Can I bring employees back to work part time?

From 1 July 2020, flexible furlough is available allowing furloughed employees to return to work on a part time basis; the employees have to be paid for the part time hours they work, with no assistance from the government, but government subsidies remain available for the hours during which the employee remains on furlough. This will help many employers ease their workforce back to work on a phased basis.

A summary of the key steps for claiming part time furlough is as follows:

Step one: Work out how many hours you need your employees to work for.

Employers will have a discretion to choose the appropriate hours and shift patterns to suit their particular business needs, except that a minimum of seven calendar days must be claimed for in each claim period and claim periods must start and end within the same calendar month because the rules will change every month (see tapering off, below).

Step two: Give staff notice and get a written agreement recording the new arrangement

There is no set minimum notice period for changing or ending furlough, but a written agreement that confirms the new furlough arrangement will be needed, which is consistent with employment, equality and discrimination laws, and kept for five years. It can be for any duration up to 31 October 2020.

You must also keep records of how many hours your employees work and the number of hours they are furloughed (i.e. not working) for six years. This is especially important given increased HMRC scrutiny of claims (see below).

Step three: Calculate and claim.

You will need to input both the number of hours an employee usually works in the claim period and the actual number of hours worked to the CJRS portal. This is complex and you should refer to the detailed Government guidance on calculating the amount you can claim which can be found here, with a worked-through example here.

When should you claim?

The guidance advises that you should ideally wait until the end of the month so that you can accurately calculate the actual number of hours worked by staff but, since claims take six days to process, most employers will claim six days before the end of the month in order to ensure that funds are available to them in time for payroll.

Tapering off: how much do I have to pay?

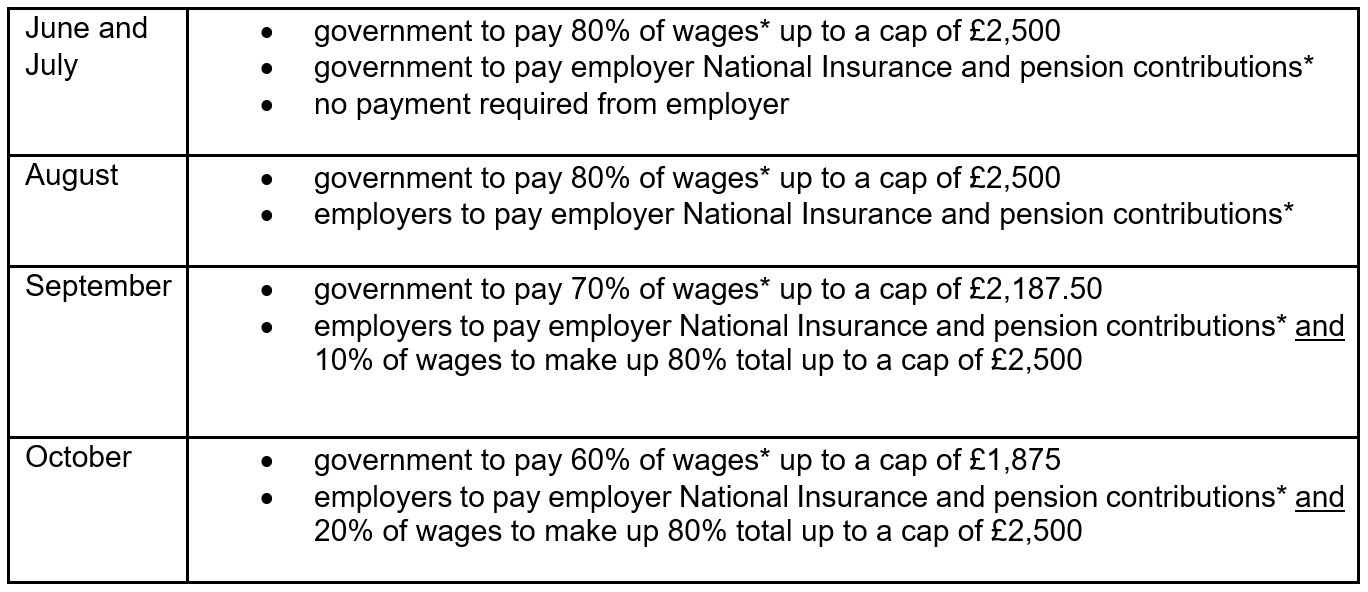

From August 2020, the level of government funding provided will taper off as employees begin to return to work and the Scheme is slowly phased out, ending completely by 31 October 2020. The following payment arrangements will apply until the end of the Scheme:

*for the hours the employee does not work.

A word of warning: increased vigilance by HMRC and new legislation

Recent Government guidance has made clear that HMRC will not hesitate in taking action against any businesses who are found to be abusing the CJRS scheme and encourages employers and employees to report any potential concerns to HMRC by either using the fraud hotline or by making a report on the online portal (further details of which are available here). 3,000 reports of fraud have been made since April.

Fraudulent claims arise where employees are asked to continue working for the business during the hours they are recorded as being on furlough, and under the latest guidance that includes any work or services, even administrative tasks. Employees are only allowed to take part in training for their employer. They can only volunteer for or work for another employer.

The governing principle, and which employers should always bear in mind, remains that the purpose of the CJRS is to support businesses who are unable to maintain their current workforce because their operations have been severely affected by Covid-19.

Draft legislation which is envisaged to be a part of the Finance Bill 2020 is being fast-tracked through Parliament which, it is reported, will give HMRC the power to force employers to repay money which was incorrectly claimed. Such employers will be given 30 days from the date the Finance Bill 2020 is approved and passed as an Act of Parliament to confess to HMRC that incorrect claims were made, otherwise the overpayment may be recovered by way of an income tax charge which may or may not include additional sums for interest and penalties. Now is a good time for employers to carry out an audit of their furlough payments and ensure their records are all in order.

If an employer realises they have made an error, and have accidentally overclaimed, e.g. because they have misinterpreted the guidance, they are required to report it the next time they make a claim through the portal and subsequent payments to the employer by HRMC will be adjusted to account for this. Employers should ensure that they maintain records of any adjustments for a minimum of six years and rectify any over-claimed payment as soon as possible. If they are not planning on making any further claims then the employer should make a payment direct to HMRC after obtaining the relevant payment reference number (for further details on making such a payment see the government guidance available here). If an employer has accidentally underclaimed, they must contact HMRC directly and further checks will be made before any additional payment is made.

Despite the government’s efforts to preserve jobs through the CJRS Scheme, some employers are facing the reality that they may not have work for all of their staff once furlough comes to an end.

Should it sadly be necessary to make staff redundant employers will need to ensure they follow the proper processes. For many employers this will be a new experience, for others it may not be something they have had to consider for some time. To assist, we set out below a step-by-step guide for employers to follow:

Step one: Is there a redundancy situation?

A redundancy situation occurs in the following circumstances:

- Business closure

- Workplace closure

- Diminished requirements for employees to do work of a particular kind.

Any of these might arise in the current climate. Employers should carefully document the business reasons for the redundancies within their organisation in case the need for redundancies is disputed.

Overarching considerations:

- If you have a contractual redundancy policy, follow this.

- Beware of the special rules which apply to some groups e.g. employees on maternity leave.

- If your process or selection criteria puts employees with certain protected characteristics at a disadvantage e.g. due to their sex, race or nationality, age or a disability, you may face costly discrimination claims.

Step two: Do you need to consult collectively?

This depends on how many redundancies, their timing, and the location of the redundant jobs:

- 20 – 99 employees at an establishment within 90 days: collective consultation must begin more than 30 days before the first redundancy is due to take effect.

- More than 99 people: consultation must begin more than 45 days earlier.

- Fewer than 20 people: collective consultation is not required, and you can skip to step five.

- If the required collective process is not followed the affected employees will be entitled to a protective award of up to 90 days’ pay.

Interaction with the CJRS Scheme?

- If you want employees exited by the first tapering-off point, i.e. 31 July 2020, you must have started or start collective consultation on 16 June or 1 July 2020 respectively depending on numbers affected.

- If the date is the end of the CJRS Scheme, you must start collective consultation on 16 September or 1 October 2020 respectively.

Step three: Notify the Government.

The department for Business, Energy & Industrial Strategy must be notified on HR1-form where an employer is contemplating dismissing 20 or more staff in a single establishment (link here). A failure to do so is a criminal offence by the employer and the officers of the employer.

Step four: Start collective consultation:

- Arrange for representatives for affected employees to be elected

- Provide representatives with information prescribed by the legislation

- Consult with the representatives about avoiding or reducing the number of redundancies, and limiting the effects of redundancies.

Step five: In addition to collective consultation, or if making fewer than 20 redundancies, an individual consultation process should be followed:

- Identify who is affected

- If you need to select from a group establish and score against objective selection criteria

- Notify employees they are “at risk” of redundancy

- Consult with at risk employees to explore whether alternatives to redundancy are possible, e.g. redeployment

- Confirm the outcome: retention or termination of employment and what their entitlements are, e.g. notice and redundancy pay

- Possibly, give the employee the opportunity to appeal.

The process will vary depending on the circumstances, your resources, and time-constraints. You will need to ensure decisions are recorded in writing. A failure to follow a fair process could give rise to unfair dismissal claims.

3. What payments are employees entitled to receive?

Notice: either statutory or contractual, and either worked or paid in lieu (if there is a contract clause which allows for this)

- Contractual entitlements, e.g. bonus or any contractual enhanced redundancy payment, accrued holiday

- Statutory redundancy payment: where the individual has worked for you for more than two years. This is calculated based on the individual’s age, length of service and a weekly pay cap which changes each April. A link to the government’s calculator is available here.

4. Changing terms and conditions of employment

With the level of government assistance under the CJRS Scheme imminently changing, and a firm end-date in sight, employers may feel compelled to seek changes to employees’ contracts either to avoid redundancies, or, at least, to limit the scale of them.

There are many contractual variations employers might consider to reduce their costs either on a temporary or permanent basis including:

- Lay-offs: temporary periods during which employees do no work but should be paid in full unless their contract specifically allows for unpaid or reduced pay lay offs or if the employee agrees to amend their employment contract to include such a provision. Employees can apply for redundancy (and will be entitled to claim redundancy pay) if they are laid off for four weeks in a row or six weeks in a 13 week period.

- Short time working where employees work, and are paid for, fewer hours

- Reduction in salary

- Deferring or reducing bonuses (where a bonus is discretionary a contractual change may not be required)

- Changes to benefits e.g. gym membership, employee discounts, buying and selling leave, less generous family friendly contractual schemes, e.g. a reduction in shared parental pay, private healthcare

- Delaying start dates for new recruits.

5. Checklist for employers contemplating contractual changes

- Is there a clause in the contract which gives the employer an express right to make changes unilaterally? A clause granting an employer the flexibility to make changes without requiring an employee’s agreement is extremely rare, especially where pay is concerned, and must be worded precisely to be valid.

- If there is a flexibility clause, an employer must give reasonable notice of the change, any change must not be made in bad faith and must not breach the implied duty of trust and confidence between employee and employer.

- If there is no flexibility clause, an employer has the following options:a. Obtain express agreement from the employee to the changes.

i. The best way to achieve this is to notify the employee in good time of proposed changes and consult with the employee about the proposals in advance

ii. Should be recorded in writing

iii. must be voluntary and free from duress (i.e. there should not be the threat of dismissal if the change is not accepted)

iv. Requires “consideration”, i.e. some sort of value exchange made by the employer in return for benefiting from the change. Under normal circumstances this might be a pay-rise but during these times it might be a role promotion without a pay rise, an additional, one-off payment, or offering additional paid annual leave. However, and although it must not be threatened, where the real alternative is closure and job losses, the continuation of employment is often enough to cement valid agreement.b. Impose the change unilaterally and rely on the employee not raising an objection and their agreement being implied over time. However, there are the risks with this approach. The employees may:

i. Work under the new terms under protest and bring a claim for breach of contract or, if the breach of contract involves a shortfall in wages, a claim for unlawful deductions from wages.

ii. In cases where the change imposed is substantial, the employer may be deemed to have constructively dismissed the employee if the employee resigns in response, in which case he may bring a claim for unfair dismissal.

iii. Refuse to work under the new terms.Case law suggests it may be possible to avoid liability for what is ostensibly a breach of contract if an employer can show there were sound, good business reasons for the change, if it consulted about the change, if the changers were reasonable in the circumstances. It may also be relevant that most other employees accepted it.

c. Terminate the existing contract and offer continued employment on the new terms.

i. There is still the risk here that the employee could work under the new contract and claim to have been unfairly dismissed from the old one. This can be a significant cost to employers since compensation for unfair dismissal can amount to the equivalent of up to a year’s pay or £88,519 plus a basic award based on age, length of service and a week’s pay capped at £538.

ii. Employers will also need to bear in mind where it proposes to dismiss and re-engage 20 or more employees, the collective consultation obligations as with redundancies (see above) will apply.

iii. Notice of dismissal must be properly provided in line with the contract or with the minimum period under statute to avoid a wrongful dismissal claim.

From a practical perspective the most important step the employer can take is to give adequate notice of the proposed change and to take the time to explain the business reasons for the change to the employees and to seek their consent to it.

Contact us

The authors of this article are happy to respond to queries from current or prospective clients of the firm. If you do not wish to instruct the firm, we hope you find this article and others we have written useful and you may wish to refer to the ACAS website https://www.acas.org.uk/. If you wish to instruct us, or to discuss instructing us, please contact one of our Employment partners directly or by using the contact form here and we will be pleased to discuss how we can assist you. If you are a journalist seeking further information, please contact us via marketing@foxwilliams.com or by phoning 020 7614 2648.

Articles and commentary by our legal experts on the impact of Covid-19 are all available here.